Image Source: Substack

PTT trading signals bring more value than you can find anywhere.

And the free access doubles the offer to make it the most unreal deal you can find anywhere.

This post aims to help you understand how to extract the most value from the signals.

Warning: Trading is a risky endeavor, if you know that you are not ready to heed the rules in this page, don’t trade, you will lose your capitalFirst, this post assumes that you have watched and practiced what is found in the page that was sent to you after you made your deposit.

If you have not watched them, stop reading this post and go back and watch them properly.

You can find the link to these guides in the WhatsApp group description.

The hardest work in trading is analysis.

That part has been done for you.

The best thing that you can do for yourself is to take the time to learn how to use the signal.

Over 80% of what you will learn from those videos and this post are things that you will learn once and then implement over and over again.

If you are done with the videos, let us go.

The lessons in this post build on what you learned in the video

The Importance of Demo Trading

First of all, you might be eager to make money,

But I urge you to devote one or two days (depending on how fast you grab the system) to trading a Demo Account.

If you check your account profile, you will see options for Real and Demo Accounts.

Demo accounts can be funded with virtual money, this would help you practice and get a hang of the real thing.

The main purpose of this is to familiarize yourself with the trading process in a risk-free way.

Also, make sure that the amount in your Demo account matches what you have in your real account.

i.e. if you funded $250 in your real account, make sure you add that same amount to your Demo account.

With that said, let's dive into other important lessons.

Understanding Signal Types

Generally, we have two types of signals.

Buy Signals

Sell Signals

The idea is to buy an asset when the price is going up and sell when the price is going down.

Now I would make use of the signals that we get a PTT to explain how to approach trading.

Buying/Selling After Range is Given

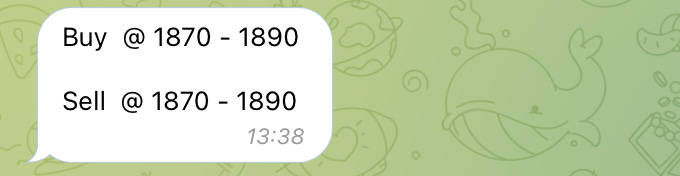

The image above shows an example of range for both a buy signal and a sell signal.

So lets so for example you were told to Buy Gold @ 1870 - 1890 and you came after the range has been given.

The best price to Buy Gold would be 1870 or the figure closest to it.

This is because the price of Gold is going up so it will move upwards past 1890 and keep going until it hits TP.

Lets assume that TP1 is 1895 and that’s the profit everyone chose to set.

Someone who entered the trade at 1870 will make more profit than someone who entered at 1875.

Also, let’s say you were told to Sell Gold @ 1870 - 1890 and you came after the range had been given.

The best price to Sell Gold at would be 1890

This is because the price of God is going down so it will move downwards from 1890 and keep going until it hits TP.

Let’s assume that TP1 is 1855 and that’s the profit everyone chose to set.

Someone who entered the trade at 1890 will make more profit than someone who entered at 1880

If you are buying at the least favorable price, be more careful when it comes to things like breaking even or setting a stop loss.

Note: these examples assumes that the leverage, lot size and capital for all parties is the same.BreakEven Best Practices

There are two types of BreakEven

Changing SL to Entry Price

Changing SL to TP

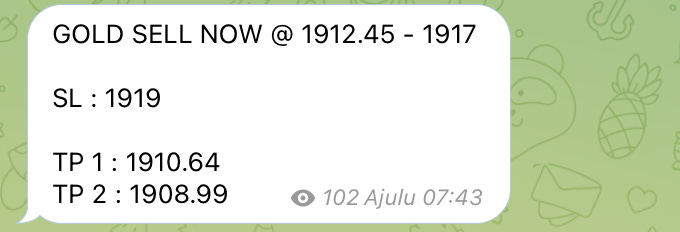

In the signal above the entry range is between 1912.45 and 1917

And being a Sell Signal the best price to buy at 1917

Let’s assume you bought at that price.

You can set TP1 or TP2 as your take-profit point.

Let’s say the price gets to 1911, and the trade is already in profit but yet to hit TP1

To breakeven, you can just change your Stop Loss from 1919 to 1917(your entry price)

Meaning if the market starts going against the signal, you won’t make a loss.

But assuming you set TP2 and your take profit, and the price hits TP1 and keeps running.

Another way to Breakeven but in a profitable way is to change your Stop Loss to TP1

So if the market wants to move against you, profit will still be made.

Reference from a Past Trade

In the trade used as an example below

The trade was already running in profit but was yet to hit TP1

The Analyst then dropped this instruction.

There are two lines of action after seeing this:

You can either exit and take the profits gotten so far

Or, change your SL to your Entry price.

Meaning at the end of the day, you would either make some profits or break even and preserve your capital.

Trading Gold

Gold is a very volatile pair.

So when trading it, you have to be stubborn with any trading rules that you set for yourself.

Whenever a signal is dropped and you see the analyst post something like this above.

Take a quick look at the chart if the price of Gold is moving up and down so fast, change your SL to Entry price to be on the safe side.

You can also use trading alerts to do this for yourself.

I will talk about setting trading alerts below.

Dealing With Emotions

Entering trades at the right range: if you enter a trade at the wrong price, you will lose money or only break even when others make significant profits.

Being on alert and making necessary modifications: make sure that you have set your telegram notification as instructed.

Using the right lot size across trades: stick to one Lot size, don’t use different lot sizes for different trades, sometimes the trades you increase your Lot size for end up hitting stoploss wiping your gains from other trades.

Not being too greedy when things are going well: a good trading day might get you very happy and excited. Don’t fall for the popular temptation of increasing your capital and lot size the next trading day.

Playing the Long Game: losses are part of trading, understanding this would help you process losses well. You are to learn from losses and not let them stop you in your tracks.

Not being Fearful when things are going wrong: the discipline to stick to trading rules is not just tested when things are going well, they are also tested when things are going wrong. Sometimes you lose out because you went against your trading rules out of fear

Understanding Lot Sizes

Growing a Small Account

If you are trading with a small capital, you have to be even more careful than normal.

Here are some extra things that you can use to keep your account safe as you grow it.

Using Price Alerts to BreakEven: When you enter a trade for a volatile pair like Gold, you can pick a price that is close to TP1 and set an alert for it.

Once the alert rings, you can modify your trade and change your SL to the entry price. Create a trading view account with this link: Trading View

You can install the App and log in once you are done.Having an income target: it is easy to be moved by people posting earnings that are the same size as your capital.

But you need to understand that you are not them. Don’t push to increase leverage or lot size to keep up.

Use a sensible lot size and stick to it. Give yourself a weekly (not daily) income target. 20% capital growth per week is ideal.

20% may look small but after a few weeks, you will have grown your capital base to something significant.

The reason you have income targets is so that you won’t over-trade.

It is not every signal that you should trade.

$2 per day is better than making $10 today and losing everything tomorrow because you are desperate to hit a certain figure.

It is hard to follow the rules when you are too emotional.

Rule Summary

If you miss the entry range, never place the trade, no matter how little the gap might look.

If you won’t be able ( school, travel, work, slow internet, about to sleep) to modify your trades, don’t enter.

Never trade our signals without a daily target. Document your trades and lessons too.

Never enter a signal if you are fearful. Take a trading break and resume when you can trade.

If you broke a trading rule and got away with it, never share it in the group. It promotes bad trading habits( you will be removed if you do this)

Install the trading alert App I talked about above and use it: Trading Alerts

More lessons will be shared in the coming weeks and months.

Subscribe so you get articles immediately after they are published.

Hello, pls can you grant access to the video tutorial?

It’s private

Patience, Discipline and paying attention to instructions is key to achieving a long term goal..

Thanks for the insightful article sir.